California's groundbreaking climate disclosure laws — SB-253 (Climate Corporate Data Accountability Act) and SB-261 (Climate-Related Financial Risk Act) — are reshaping corporate climate reporting in the United States. However, as of December 29, 2025, the two laws are on different implementation tracks.

SB-253 is advancing through formal rulemaking, with CARB proposing initial emissions reporting deadlines beginning in 2026, while SB-261 enforcement is currently stayed by a Ninth Circuit court order, and CARB has confirmed it will not enforce the statute’s January 1, 2026 deadline while litigation is ongoing.

Understanding the foundations: California SB-253 and SB-261 explained

The Climate Corporate Data Accountability Act (SB-253)

SB-253 requires large businesses to publicly disclose their greenhouse gas emissions annually. SB 253, as amended by SB 219, directs CARB to adopt regulations by July 1, 2025, requiring "reporting entities" — businesses with total annual revenues over $1 billion that are formed under state or federal law and do business in California — to annually disclose their Scope 1, Scope 2 and eventually Scope 3 emissions.

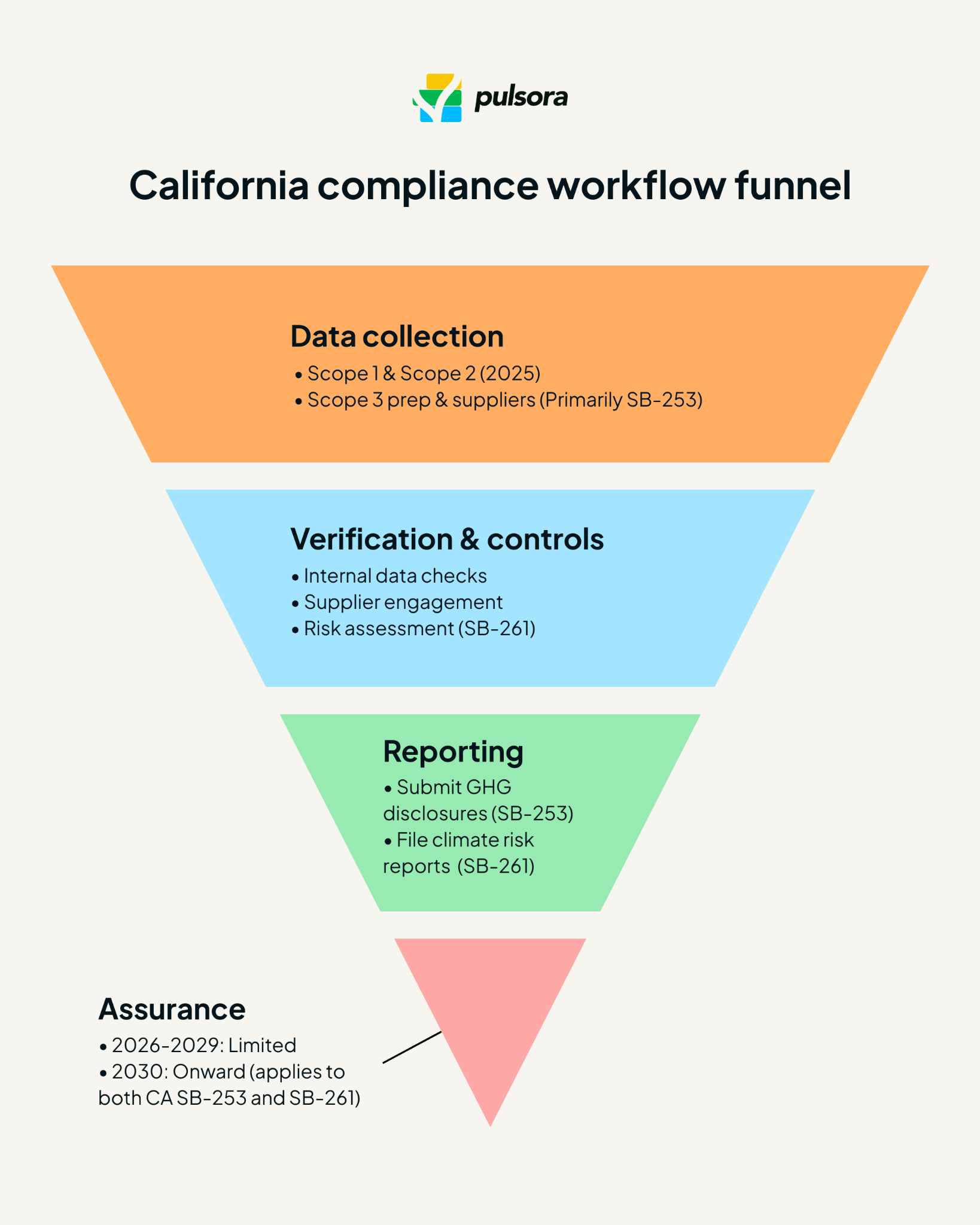

The reporting framework for SB-253 follows the widely-adopted GHG Protocol standards, ensuring consistency with existing sustainability reporting practices. Covered entities must begin with Scope 1 and Scope 2 emissions reporting in 2026, covering their 2025 fiscal year data. Scope 3 emissions disclosures will follow, starting with reports covering 2026 data due in 2027.

The Climate-Related Financial Risk Act (SB-261)

SB-261 is intended to require biennial public reporting on climate-related financial risks and mitigation strategies by companies with over $500 million in annual revenue that do business in California.

However, SB-261 enforcement is currently paused pursuant to a Ninth Circuit stay, and CARB issued an enforcement advisory confirming it will not enforce the statutory January 1, 2026 reporting deadline while litigation is pending. Companies may voluntarily prepare or submit reports during this interim period, but penalties are not currently being enforced.

Who must comply: Understanding revenue thresholds and applicability

SB-253 covered entities

Any business entity with total annual revenues exceeding $1 billion that conducts business in California falls under SB-253's jurisdiction. This includes parent companies and their subsidiaries, partnerships, and any business structure organized under state or federal law. CARB estimates that 2,596 entities are subject to SB 253.

The revenue thresholds apply to gross receipts calculated according to California's taxation code, ensuring consistency with existing tax reporting frameworks. Non-profits and certain exemptions may apply, but most large enterprises operating in California will find themselves subject to these disclosure requirements.

SB-261 reporting entities

SB-261 will cast a wider net if or when enforcement resumes, applying to companies with annual revenues exceeding $500 million. 4,160 are subject to SB 261, reflecting the law's broader scope for climate-related financial risk disclosure. This lower threshold means many more companies must prepare for biennially reporting on climate risks and their financial implications.

Critical compliance deadlines for CA SB-253 and SB-261

Updated implementation timeline (as of Dec 29, 2025)

- December 1, 2025: CARB opened a voluntary SB-261 submission docket

- SB-261: Enforcement stayed; revised reporting timeline pending outcome of Ninth Circuit appeal

- SB-253 (proposed):

- Scope 1 & 2: CARB has proposed an initial reporting deadline of August 10, 2026

- Scope 3: Expected to begin for reporting year 2027, subject to final regulations

All dates remain subject to final CARB rulemaking.

Ongoing reporting requirements

After the initial reporting period, companies must maintain annual emissions reporting under SB-253 and biennial climate risk disclosure under SB-261. These reporting deadlines create an ongoing compliance framework that requires sustained attention from sustainability teams and stakeholder engagement across the organization.

Penalties and enforcement: Understanding the financial stakes

SB-253 penalties for emissions reporting

Non-compliance with SB-253 carries significant financial consequences.

Non-compliance with the reporting requirements can result in administrative penalties, with fines reaching up to $500,000 per reporting year based on the violator's compliance history. However, there's important relief for the initial reporting period.

CARB has clarified that no penalties will be imposed in 2026 for SB 253 as long as companies demonstrate a "good faith effort" in preparing their disclosures. This grace period recognizes the complexity of implementing comprehensive emissions data collection and reporting systems.

SB-261 penalties for climate risk disclosure

Penalties relating to the financial risk report under SB 261 can be up to $50,000 per year. While lower than SB-253 penalties, these fines still represent significant financial exposure for non-compliance with climate-related financial risk disclosure requirements.

Good-faith efforts and safe harbor provisions

The concept of good faith efforts provides crucial protection and an enforcement notice for companies working toward compliance.

CARB has indicated that leniency will be granted until 2026 for organizations that make good-faith efforts to comply. Additionally, there is a safe harbor for scope 3 emissions disclosures; companies are not subject to administrative penalties for misstatements about scope 3 emissions made with a reasonable basis and disclosed in their reports.

These provisions recognize that supply chain emissions data can be challenging to obtain and verify, particularly for complex value chains spanning multiple tiers of suppliers and business partners.

Assurance requirements: Building credible reporting systems

Third-party assurance mandates

Both laws require third-party assurance to ensure the credibility of emissions data and climate risk disclosures. For SB-253, companies must obtain limited assurance for their emissions reporting starting in 2026, with reasonable assurance required beginning in 2030.

The assurance requirements follow established auditing standards, requiring companies to work with qualified providers who can verify the accuracy and completeness of their GHG emissions calculations and climate-related financial risk assessments.

Implementing robust controls

Successful compliance requires implementing strong internal controls and data management systems. Companies should establish clear processes for emissions data collection, verification procedures for supply chain information, and documentation systems that can support third-party assurance engagements.

ESG professionals should work closely with their finance and operations teams to ensure that climate disclosure processes integrate effectively with existing financial reporting and operational data systems.

Regulatory developments and implementation updates

CARB's rulemaking process

SB-253 includes phased third-party assurance requirements, beginning with limited assurance for Scope 1 and Scope 2 emissions, and progressing toward reasonable assurance by 2030, subject to final CARB regulations.

While SB-261 references credible, decision-useful disclosures, assurance requirements are not currently enforceable, given the ongoing litigation and enforcement stay.

CARB continues to advance SB-253 through formal rulemaking, including proposed regulations released in December 2025 that address reporting timelines, program funding, and administrative requirements.

SB-261, meanwhile, remains subject to active litigation. In November 2025, the Ninth Circuit issued a stay preventing enforcement, and CARB subsequently confirmed it will not enforce the statutory deadline while the appeal is pending. CARB has committed to issuing updated guidance and timelines following resolution of the case.

Legal challenges and regulatory stability

While some legal challenges have emerged around these California climate disclosure laws, the regulatory framework continues to advance toward implementation. Companies should monitor ongoing legal developments but should proceed with compliance planning to avoid penalties and ensure readiness for the approaching deadlines.

Strategic preparation: Key takeaways for sustainability professionals

Sustainability teams should focus on several critical preparation areas most immediately:

Data systems assessment

Evaluate current emissions data collection capabilities, particularly for Scope 1 and Scope 2 emissions. Identify gaps in data quality, completeness, and verification processes.

Supply chain engagement

Begin engaging with key suppliers and value chain partners to understand their emissions reporting capabilities and prepare for future Scope 3 emissions disclosure requirements.

Climate risk assessment

Develop or enhance climate-related financial risk assessment capabilities, focusing on both physical and transitional risks that could impact business operations and financial performance.

Cross-functional coordination

Build strong working relationships between sustainability, finance, legal, and operations teams to ensure coordinated compliance efforts.

Building long-term capabilities

Beyond initial compliance, companies should view these requirements as opportunities to strengthen their overall corporate sustainability programs. The disclosure requirements create valuable frameworks for improving climate risk management, enhancing stakeholder engagement, and building competitive advantages through transparent sustainability reporting.

Companies that excel in meeting these disclosure requirements may find themselves better positioned for capital markets access, stakeholder trust, and operational resilience in a climate-constrained economy.

Preparing for success: Next steps for your organization

Compliance planning timeline

With reporting deadlines approaching rapidly, companies should establish clear project timelines that account for data collection, system implementation, stakeholder coordination, and assurance provider selection. The complexity of these requirements means that successful compliance requires sustained effort over many months.

Resource allocation and team-building

Effective compliance often requires additional resources, whether through hiring sustainability professionals, engaging external consultants, or investing in new technology systems. Companies should assess their current capabilities and identify resource gaps early in the preparation process.

Stakeholder communication strategy

These disclosure requirements create new opportunities for stakeholder engagement around climate issues. Companies should develop communication strategies that help stakeholders understand their climate risks, mitigation strategies, and progress toward emissions reduction goals.

The future of corporate climate disclosure

California's leadership in climate disclosure is influencing similar initiatives across other states and at the federal level. The Securities and Exchange Commission's climate disclosure rules, though currently facing legal challenges, reflect similar principles of transparency and accountability.

For sustainability professionals, these California climate disclosure laws represent both a compliance challenge and a strategic opportunity. Companies that approach these requirements thoughtfully — building robust data systems, engaging meaningfully with stakeholders, and integrating climate considerations into business strategy — will be better positioned for success in an increasingly climate-conscious business environment.

Avoid penalties and achieve compliance with Pulsora

Checking every box on a compliance checklist for SB-253 and SB-261 requires more than good intentions — it demands reliable data systems, seamless supplier engagement, rigorous risk assessments, and audit-ready assurance.

Pulsora is built to help you get there.

Our platform centralizes emissions data collection, streamlines Scope 3 supplier requests, aligns financial risk disclosures with leading frameworks, and integrates third-party assurance to ensure accuracy and credibility. With Pulsora, you can move from uncertainty to confidence, knowing every step of your compliance journey is supported — and every item on your checklist is accounted for.

Ready to consider a solution to help with California compliance? See our roundup of the best California climate software.

Click here for a personalized demo on how we can help.

Regulatory status reflects publicly available guidance as of December 29, 2025. California climate disclosure requirements remain subject to ongoing rulemaking and litigation.